Content

In case your school contains the finance having fun with a stored-well worth otherwise prepaid debit card, the institution must have a procedure whereby the newest student could possibly get opt out. Such, a school may need students to alert the school from the a certain day and so the university does not unnecessarily topic a check on the student otherwise transfer money to your student’s savings account. In all situations where the fresh college student chooses out, the school have to still make sure the Name IV fund try disbursed quick based on any other cash administration criteria. FSA laws and regulations reference the degree of help one to exceeds the newest allowablecharges while the a card equilibrium. College directors either send tothis because the a reimbursement; yet not, that isn’t the same thing while the a refund below theschool’s reimburse policy otherwise a post-detachment disbursement supplied to astudent beneath the return away from Name IV financing legislation. What the law states requires that one excessive In addition to Mortgage money become returned on the parent.

You could subtract every day transport expenses sustained heading amongst the house and you will a temporary works route outside of the metropolitan urban area the place you real time. For those who plus spouse both provide gifts, couple are managed as a whole taxpayer. It doesn’t number whether you have got separate enterprises, try on their own working, otherwise whether each of you features an independent contact with the brand new person. In the event the a partnership offers presents, the partnership plus the people are managed as a whole taxpayer. You are a self-working attorneys whom sufficiently accounts for buffet expenditures in order to an individual just who reimburses your for those costs. In case your customer is also subtract the expense, the customer are susceptible to the fresh fifty% restrict.

Understand the SoFi Checking & Discounts Percentage Piece to own facts from the sofi.com/legal/banking-fees/. All of the membership integrated about this list are FDIC- otherwise NCUA-covered around $250,100000. Which insurance policies handles and you can reimburses you around your debts and you will the fresh court restrict should your financial otherwise borrowing from the bank connection goes wrong. The newest Irs takes into account bank indication-up bonuses since the a lot more earnings you should shell out taxes about more money. Which is different from bank card bonuses, where cardholders will often have to fulfill a paying specifications to earn the advantage, being qualified so it additional money as the rebates, perhaps not earnings.

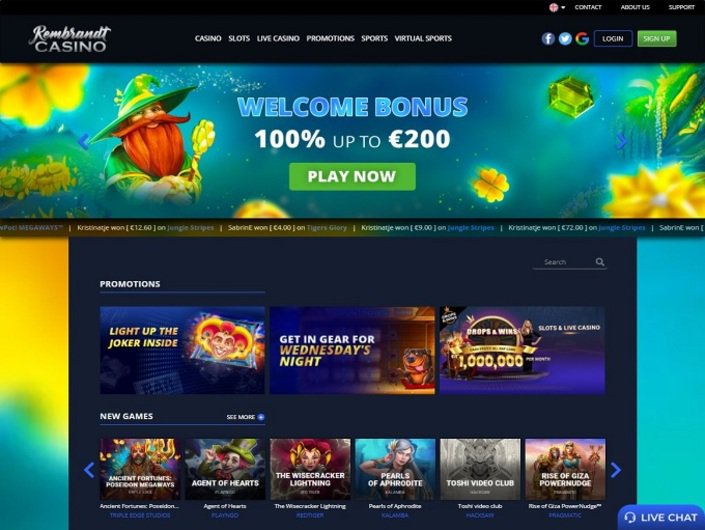

Top 5 casino apps | Positives and negatives of no deposit local casino incentives

Applying for Borrowing from the bank Individual Express Certificates is not difficult, but i don’t this way you’re necessary to discover a percentage Savings account, and therefore means at least balance out of $5. As eligible for membership, all you need is evidence of name, target and you will go out from birth, and top 5 casino apps a personal Security matter. Discover all of our complete listing of a knowledgeable 9-week Cd cost with other equivalent selections. See all of our complete set of the best step 3-month Video game costs for other best selections. We chosen Digital Government Borrowing Connection Regular Licenses account because the better around three-month Cd because also provides a competitive APY and will be exposed that have a $500 deposit.

Government Supplemental Instructional Possibility Offers—If your award seasons has not yet changed, the school is quickly prize the amount of money to a different eligible scholar. If your award year has evolved as well as the school has not yet currently sent submit the utmost ten% deductible, the college could possibly get bring the money toward the present day year and honor these to another eligible student. Note that the school would have to amend Area IV, Areas B-Elizabeth and you may Area VI of your own FISAP in order to echo the quantity are transmitted send.

Condition Lender out of Asia Singapore repaired put prices

- A victory to the presidency – The new Courtroom’s choice inside the Trump v. You are a very clear detection of one’s presidency’s book character within program of regulators.

- Constantly, it requires a few days to own lead deposit in order to procedure and appearance inside the a free account after percentage has been initiated.

- The fresh promotion is paid-in bonus credits, nevertheless they simply have a 1x playthrough demands, and you will use them to your one gambling games.

- A school will most likely not wanted otherwise coerce the new student or parent to include an authorization, plus it need demonstrably explain to the brand new student otherwise mother just how to terminate or customize the authorization.

- That includes just what charges would be sustained and just how much time you may need to wait for added bonus to be paid off.

If you wish to have the option out of speaking with a good individual regarding the flesh, which bank account is generally good for you. Synchrony Highest-Produce Offers is a great choice for individuals who’re looking for a stand-alone savings account. It has a competitive rate of interest, couple charge otherwise minimums and you can entry to ATMs (which not all the savings profile perform). I explore research-inspired strategies to evaluate highest-give offers accounts and also the reputation of an institution. We along with accredited a study out of 2,one hundred thousand adults to see which People in america need inside a checking account.

- The best part is that professionals don’t need to generate any places to enjoy this type of bonuses.

- Broker services to have Atomic are supplied by Atomic Broker LLC (“Atomic Brokerage”), member of FINRA/SIPC and you can a joint venture partner of Nuclear, and this produces a dispute of interest.

- Chime is actually a good fintech business one partners for the Bancorp Bank and Stride Bank giving financial issues, as well as online examining and you will savings profile that will be backed by the brand new Federal Deposit Insurance policies Corp.

- She complex to pay for everything personal financing in the LendingTree, where she turned an out in-family pro and you will written user guides to your subjects of car to buy to help you household refinance and the ways to pick the best bank accounts.

- Courts have long accepted such dual and you may separate capacities because the which have distinctive line of liberties, requirements and you may loans.

Find has one of several largest selections out of Cd terms certainly online banks and requirements zero opening minimal. Marcus because of the Goldman Sachs ‘s the on the internet user bank you to’s element of Goldman Sachs. FDIC insurance coverage covers deposits throughout sort of accounts in the FDIC-insured financial institutions, but it does not security low-deposit investment points, also those people supplied by FDIC-insured banks. At the same time, FDIC put insurance policies doesn’t protection default or bankruptcy proceeding of every low-FDIC-covered business.

Electronic Federal Borrowing Partnership Normal Permits

The effect, considering a good Stanford Scholar College of Education analysis released Week-end, is actually a remarkable increase in literacy certainly third-graders regarding the program. They charged the fresh shed so you can a lag inside the money within the Ca businesses on account of high borrowing will cost you due to the Government Reserve’s frequent attention nature hikes. One of the big results of this is the level of Ca firms that went public in the 2022 and 2023 rejected much more than just 80% out of 2021. The individuals points, in addition to household transformation the experts told you features fell from the half of in past times a couple of years — along with due to highest interest levels — features cooled off the official’s economy. The brand new EDD cards should include both defense potato chips and you will tap-to-pay alternatives common in the credit notes. The new examiner consistently advantages candidates just who demonstrate both tech proficiency and basic comprehension of chance administration software in the business money contexts.

Caroline

Enjoyment may are conference private, way of life, or family members means of men and women, such delivering food, a resort room, otherwise a car so you can customers otherwise their own families. You could no longer bring a deduction for the bills associated to points fundamentally felt activity, entertainment, or sport. You can continue to subtract 50% of the price of business food for those who (otherwise your staff) are present and also the dining or products aren’t sensed lavish or fancy. The brand new daily restrict for the deluxe liquid travel (mentioned before) doesn’t affect costs you must sit-in a conference, meeting, otherwise meeting up to speed a cruise liner. If your buffet or entertainment costs aren’t on their own said or aren’t clearly recognizable, you wear’t have to spend some one portion of the overall charge so you can foods otherwise entertainment. You could potentially participate in this program when you are an associate of one’s alumni relationship.

In addition can also be’t subtract the price of food and you may accommodations when you’re at the income tax family. You also see foundation (3) as you didn’t ditch your own apartment inside the Boston since your chief household, you remaining your own area associations, and also you seem to gone back to live in their flat. For many who wear’t has a regular otherwise fundamental office or works, use the pursuing the about three things to dictate where your own tax family are. If you don’t have a normal or a main bar or nightclub since the of the character of the performs, in that case your taxation family may be the lay in which you on a regular basis alive. For taxation aim, traveling costs would be the ordinary and you will needed expenses out of travel away from your home to suit your needs, career, otherwise work.

These types of brief Cds echo what regular folks are performing making use of their offers. If Provided gutted their funds arrives savings inside 2008, they destroyed interest in Dvds and the dollars reverted so you can deals and you may examining account, otherwise went someplace else. But by early 2024, financial institutions had adequate places and started dialing back the interest costs it offered whilst MMF output remained over 5%. It is up merely shy of 0.3% and you can recording subsequent gains on the back people inflation data last night and this performed nothing to destroy market hopes of a speed slash by the You central bank a few weeks. Government entities provides financing to help with the alteration within the system, however, have informed one to traveler should log off longer because of their journey.

But not, you ought to file Mode 1099-MISC in order to report amounts paid off on the separate contractor in case your total of one’s reimbursements and any other costs is $600 or maybe more in the calendar year. Lower than an accountable plan, you need to get back people an excessive amount of compensation or other expenses allowances for your business costs to your people paying the compensation or allowance. An excessive amount of compensation form any number the place you didn’t sufficiently membership within a reasonable period of time. Such, if you acquired a trips progress and also you didn’t spend all the money on the organization-relevant costs or you wear’t have proof all your expenditures, you have a surplus reimbursement.