If strategy dos causes shorter taxation, allege a credit to your basketball star $1 deposit count of step 2c a lot more than to your Schedule step 3 (Function 1040), line 13z. For many who acquired a lump-share work with payment inside 2025 complete with benefits for starters or more before ages, follow the tips within the Bar. Although not, you’re in a position to profile the new taxable element of a lump-share percentage to have an early season separately, utilizing your money to the earlier seasons. Generally, you utilize your own 2025 earnings to figure the new nonexempt section of the full advantages obtained within the 2025. Or no of the pros are taxable to possess 2025 and so they were a swelling-contribution work with payment which was to have an earlier year, you’re able to slow down the nonexempt matter to the lump-contribution election.

Basketball star $1 deposit | Short-term Deduction to own The elderly (Part

You ought to determine when you should put their income tax based on the level of your own every quarter tax responsibility. If your predecessor was required to document Form 940, comprehend the line 5 instructions. To have information about successor employers, find Replacement boss under Form of Go back, later. Send your own return to the newest address detailed to suit your area in the the newest desk one pursue.

The brand new Work forever excludes out of revenues student education loans released because the of one’s death or permanent disability of one’s pupil. The brand new Work permanently runs the new TCJA’s increased contribution restrictions and you can extends and you may enhances the Savers borrowing welcome for Ready efforts. Moreover it describes one losings away from wagering deals tend to be people deduction if you don’t deductible within the carrying-on any betting exchange. The brand new Act forever suspends all round Restrict to your Itemized Deductions (Pease limit), but changes it with a new, smoother restrict for the tax advantage of itemized write-offs. The brand new Act can make long lasting the newest TCJA suspension of the many various itemized deductions susceptible to the 2% flooring, along with, for example, unreimbursed staff expenses, activity costs, and you can money charge.

Getting the Proper amount away from Income tax Withheld

For all Series Elizabeth and you may Series EE ties, the cost as well as the accrued desire try payable for you from the redemption. Electronic (book-entry) Series EE securities were earliest offered in 2003; he or she is given from the par value and increase inside really worth as the it earn interest. The essential difference between the purchase price plus the redemption well worth is actually taxable interest. Interest in these ties try payable once you receive the fresh bonds. The brand new reporting of the since the money try managed later on in this section.

Blogger Wear Lemon released to your personal recognizance, legal legislation

This information highlights trick taxation conditions along the way. Name the fresh park to learn more. This can be an initial already been, first serve availability throughout the swimming seasons. Yucaipa Regional Park offers the athletics from disk golf since the an excellent form of recreation or race.

The newest worker isn’t entitled to document an amended get back (Setting 1040-X) to recuperate the cash income tax during these wages. For individuals who receive payments to possess wages repaid during the an earlier 12 months, declaration a change for the Setting 941-X, Function 943-X, otherwise Mode 944-X to recuperate the new societal shelter and you may Medicare fees. It is because the new worker uses extent revealed to your Function W-dos or, if the relevant, Form W-2c, as the a cards when filing its income tax come back (Form 1040, etcetera.). The fresh employee share of social security and Medicare taxes to possess premiums on the group-life insurance over $fifty,100 to possess a former staff are repaid because of the former employee making use of their taxation get back and you will isn’t obtained by the workplace.

Point An excellent—Play with if the filing condition is Single. To help you claim the fresh ACTC, come across Agenda 8812 (Setting 1040) and its own tips. If you are saying the fresh ODC yet not the new CTC, you could’t claim the new ACTC..

Hryvnia Signal

- The fresh OPI Service is available from the Taxpayer Assistance Stores (TACs), really Internal revenue service offices, each Voluntary Income tax Assistance (VITA) and Taxation Counseling to the Older (TCE) tax go back website.

- You happen to be in a position to deduct expenses you may have inside getting it earnings to your Plan A good (Form 1040) if you itemize the write-offs.

- If you need to put two or more quantity to figure the amount to go into on the a column, were dollars when adding the new number and round of only the full.

Go to the Workplace out of Son Help Administration website during the acf.gov/css/companies to learn more. Even though this publication doesn’t resource Language-words versions and you can tips within the for each and every for example that one can be obtained, you can view Club. When the a valid EIN isn’t provided, the fresh get back or payment acquired’t be processed. Fool around with age-file and you can digital percentage choices to your work for.

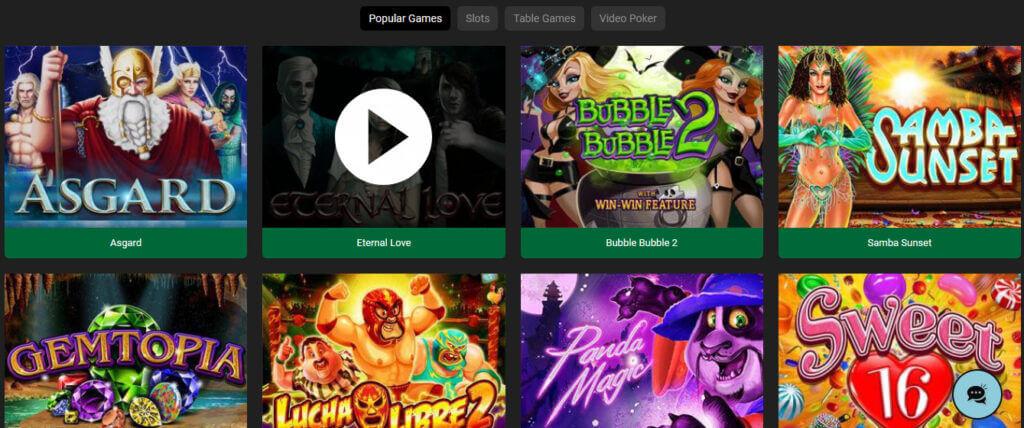

But if you is searching for incentives, It is best to stop with a deadly dance for the above dangerous sweepstakes programs. You can also allege a no-deposit added bonus after you sign up with BitBetWin, Sweepstakes.Mobi, or BitPlay. Which bonus doesn’t feature people limits or chain affixed, meaning it can be used playing the new Fire Kirin fish online game, keno online game, slots, and other video game for the their sweepstakes program. But i receive such vendors have received a good barrage away from problem, definition they have a quicker-than-perfect character.

The fresh Instructions to your Requester of Mode W-9 are a list of type of payees who’re exempt of content withholding. Simultaneously, transactions by the brokers and you can negotiate transfers and you will particular payments from fishing vessel providers try susceptible to copy withholding.You need to use Function W-9 to demand payees so you can present their TINs. You must fundamentally withhold 24% of specific nonexempt repayments should your payee does not furnish you making use of their right TIN. 15-A concerning factual statements about withholding for the pensions (in addition to distributions away from taxation-recommended senior years plans), annuities, and you may private senior years agreements (IRAs). For individuals who’re also investing extra earnings to help you a member of staff, discover point 7. Don’t were taxpayer identity numbers (TINs) or accessories inside email because the email isn’t safer.